An investigation may determine that the company wrote a check for $20,000, which still needs to clear the bank. In this case, a $20,000 timing difference due to an outstanding check should be noted in the reconciliation. Timing differences occur when the activity that is captured in the general ledger is not present in the supporting data or vice versa due to a difference in the timing in which the transaction is reported. Account reconciliations are an essential part of financial management in any business.

Account Reconciliation Best Practices For Ensuring Accuracy

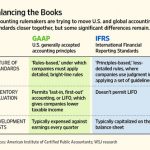

Reconcile general ledger accounts to sub-ledgers or create a schedule of underlying transactions and list discrepancies by item (which may require recording or journal entry adjustments). The reconciliation spreadsheet should be carried forward from month to month for each yearly accounting period. Accountants compare the general ledger balance for accounts payable with underlying subsidiary journals. GAAP (generally accepted accounting principles) requires accrual accounting to record accounts payable and other liabilities in the correct accounting period. Some businesses with a high volume or those that work in industries where the risk of fraud is high may reconcile their bank statements more often (sometimes even daily).

Business-specific reconciliations

This saves your company from paying overdraft fees, keeps transactions error-free, and helps catch improper spending and issues such as embezzlement before they get out of control. Reconciling your bank statements simply means comparing your internal financial records against the records provided to you by your bank. This process is important because it ensures that you can identify any unusual transactions caused by fraud or accounting errors.

How to reconcile balance sheet accounts

Prepaid assets are prepaid expenses that are capitalized as an asset when paid in cash. Prepaids are recognized gradually as an expense, using a monthly allocation with a journal entry to reduce the prepaid asset balance and record the expense on the income statement. Fixed assets should be rolled forward by ensuring that purchases, sales, retirements and disposals, and accumulated depreciation are correctly recorded.

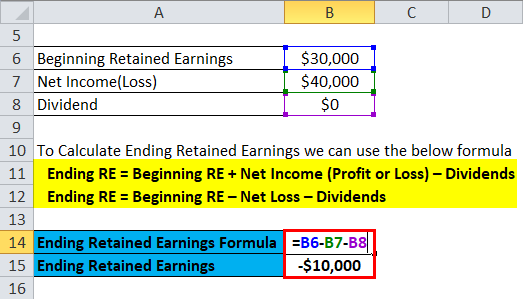

But for all methods, if you’re not using reconciliation software, the first step will likely be importing account transactions from your ERP or accounting software into an Excel spreadsheet. Thirdly, account reconciliation is vital to ensure the validity and accuracy of financial statements. Individual transactions are the building blocks of financial statements, and it is essential to verify all transactions before relying on them to produce the statements. For example, while performing an account reconciliation for a cash account, it may be noted that the general ledger balance is $249,000. Still, the supporting documentation (i.e., a bank statement) says the bank account has a balance of $249,900. For example, while performing an account reconciliation for a cash account, it may be noted that the general ledger balance is $500,000.

- A business will observe the money leaving its accounts to calculate whether it matches the actual money spent.

- Account reconciliation is typically carried out at the end of an accounting period, such as monthly close, to ensure that all transactions have been accurately recorded and the closing statements are correct.

- In fact, most jurisdictions have requirements for trust account reconciliation.

- Similarly, if you were expecting an electronic payment in one month, but it didn’t actually clear until a day before or after the end of the month, this could cause a discrepancy.

- However, in reality, there are often still discrepancies due to timing issues related to transactions (i.e. cash in transit) or errors from external providers (i.e. omitted transactions).

- Perhaps the Excel spreadsheet you used to calculate the journal entry has a formula error.

For his first job, he credits 5000 ZAR in revenue and debits an equal amount for accounts receivable. Johannes has therefore achieved reconciliation because both his credits and debits are equal. By prioritizing reconciliation in accounting, lawyers and law firms can maintain financial accuracy and compliance, but that doesn’t mean that lawyers need to spend hours each day looking at accounts on paper or in Excel. By leveraging technology for more efficient reconciliation processes, lawyers can save time and greatly reduce the chance of error. Auditors review, analyze, and test client-prepared account reconciliations during the annual audit of the financial statements, trial balance, general ledger, and records.

This highlights the significance of accurate accounting reconciliation in detecting and preventing fraudulent activities within an organisation. By reconciling financial records, such as bank statements, invoices and receipts, businesses can identify discrepancies and irregularities and protect themselves against potential fraud. Reconciliation in accounting is the process of comparing multiple sets of financial records (such as the balances and transactions recorded in bank statements and internal records) to ensure their correctness and agreement. Stripe’s reconciliation process involves comparing your business’s internal records, such as invoices, with external records such as settlement files, payout files and bank statements.

It also includes car rental loss and damage insurance, as well as return protection. Bank Triple Cash Rewards Visa Business Card, you’ll get an additional $500 cashback as an introductory bonus. Corpay One Mastercard is a charge card that you can use to make purchases as well as pay both your bills and vendors. Ramp’s charge card program comes with the additional perk of tools designed to help your business track and reduce its spending.

As a business, the practice can also help you manage your cash flow and spot any inefficiencies. The very basis of double-entry accounting is itself an internal https://www.accountingcoaching.online/what-are-different-types-of-contract/ reconciliation. Transactions that impact a company’s bottom line — net income — are split between accounts on the balance sheet and the income statement.

Once you have a solid starting point, look at the reconciling items in last period’s ending balances. This is the one that keeps business owners and finance and accounting professionals up at night. While some fraudsters exhibit a true evil genius in covering their tracks, most thieves aren’t that clever. Careful attention to details 2020 social security taxable wage base and review of reconciliations by someone who doesn’t work with that account can help catch many instances of fraud. No matter how diligent the accounting team is, sometimes a transaction just slips through the cracks. Businesses that spend lots of time in the air will enjoy the travel cashback opportunities with this card.

The card carries no annual fee and has a variable APR, typically ranging from 18.49% to 28.49%. This card is suitable for businesses with limited or poor credit that still want to earn rewards on their spending. Additional features include fraud protection, overdraft protection, and online and mobile banking. A premium business travel https://www.adprun.net/ card offering high reward rates on travel purchases and access to luxury travel benefits. Account reconciliation is a crucial function in business accounting that helps address several fundamental objectives in the accounting process. Companies often pay some expenses or for some purchases in advance, especially when they are regular.

Accounts reconciliation helps take stock of the assets that a company has and enables the balance sheet to reflect the true value. After 60 days, the Federal Trade Commission (FTC) notes, you’ll be liable for “All the money taken from your ATM/debit card account, and possibly more—for example, money in accounts linked to your debit account.” Update the internal data source being reconciled to record all new transactions (i.e. payments, issue of new invoices, bank charges and interest received) from the external document. Companies which are part of a group tend to perform intercompany reconciliations at month-end.