Yes, this requirement is equivalent to a bachelor’s degree, and many state boards also prefer you have your degree in accounting. In order to become an enrolled agent, you must either take the Special Enrollment Exam (SEE), also tax preparer vs cpa known as the enrolled agent (EA) exam, or have previous work experience at the IRS. While passing the exam is much easier once you’ve acquired several years of tax experience, there is no prerequisite for taking the EA exam.

What if I have a complaint about a tax preparer?

EAs primarily focus on tax matters, while CPAs offer a wider range of financial services. They are licensed on a federal level to represent clients before the IRS for tax issues, while CPAs are state-licensed. Additionally, EAs https://www.bookstime.com/ may be more cost-effective for basic tax filing, while CPAs’ comprehensive financial services might command higher fees. They’re also a great option if you need tax preparation and planning advice for an individual or business.

Read why our customers love Intuit TurboTax

Second, EAs must complete 72 hours of continued education every three years. In this blog, we hope to clear up any confusion on the enrolled agent vs CPA mix-up. To learn more about how we manage and simplify payroll for small businesses, check out The Connected Guide to Small Business Payroll.

EA vs CPA: The requirements

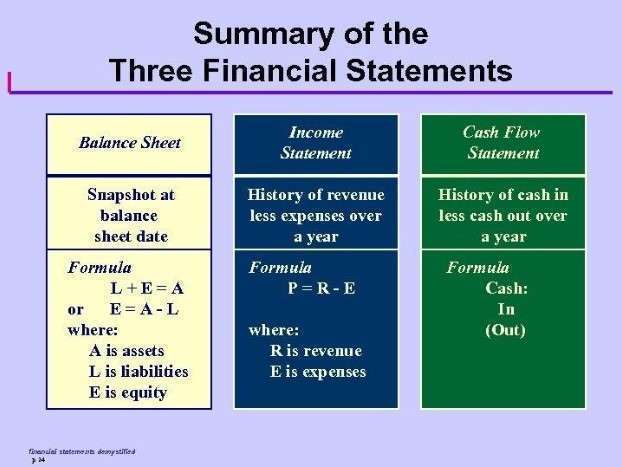

Or, with TurboTax Live Full Service, a local tax expert matched to your unique situation will get your taxes done 100% right – as soon as today. Whichever plan you choose, you’ll get you taxes done with 100% accuracy and your maximum refund, guaranteed. To become a CPA a person must take 150 hours of public accounting courses, typically done at a college or university. Certified public accountants, or CPAs, have a more flexible and expansive repertoire than EAs. They deal in all sorts of realms within the tax world, making them a great choice if your questions involve multiple topics.

- They may be auditors, financial planners or business consultants, for example.

- Even though it is a difficult path, you don’t need to do this alone.

- While passing the exam is much easier once you’ve acquired several years of tax experience, there is no prerequisite for taking the EA exam.

- In case you fail an EA exam part, you can take each section a total of four times during a single testing window (May 1 of one year to February 28 of the next).

- Thus, while an EA’s expertise only includes tax preparation, their representation rights are unlimited.

- Not only is this reflected in their background, even their credentials limit their scope.

When discussing financial help for your business, CPA and EA are two acronyms that may emerge, commonly listed side-by-side or used interchangeably. Do your research, including reading reviews and asking people you trust for referrals. A CPA might be a better choice if you have a more complex tax situation, like a partnership or corporation with multiple shareholders. If you want to take it a step further, you can take the Non-Attorney Exam, which would authorize you to represent clients in Tax Court. In this path, you can work at any company or industry and expect to make an average salary of $68,000 – $125,000³. For more information on the exams, check out our free EA Exam Guide and our CPA Exam Guide.

CPA and EA Exams: Which is Harder?

The reason for this is the amount of information both exams cover. EAs must be tax experts, so the SEE goes into great depth on tax matters. However, the CPA Exam covers four different subfields of accountancy. Finally, once you pass the EA exam and are ready to become an enrolled agent, you’ll have to pay the IRS $140 to complete the enrollment process. Over the course of becoming an EA, you’ll also want to consider additional enrolled agent exam costs covering retakes, testing appointment reschedules, and continuing education courses. Most people consider Part 1 (Individuals) and Part 3 (Representation, Practices, and Procedures) to be the easiest.

- Whether you want an expert to do your taxes from start to finish, or expert help while you file on your own, TurboTax has expert-backed offerings to meet your needs.

- In other words, a CPA is the go-to if you’re looking for a broad scope of expertise.

- Someone may earn an accounting degree, work in the accounting industry, and refer to themselves as an accountant, but that does not mean they have earned the CPA credential.

- The most popular EA course, Gleim EA Review, costs between $380 and $630, depending on your course package.

- In fact, you can schedule and sit for the exam as soon as you obtain a Personal Tax Identification Number (PTIN), even if you are still in college.

- After a candidate has passed the qualifying exam, and a final suitability and background check, the federal government then recognizes them as EA tax professionals.

This privilege allows them to represent taxpayers in matters relating to the Internal Revenue Service (IRS), such as tax collections, audits, or appeals. If your path to the IRS enrolled agent credential runs through the EA exam, you don’t need to meet an experience requirement. And once you’ve passed, you can apply for enrollment by filling out Form 23. The processing of your application can take 60 days (or 90 to 120 days if you’re a former IRS employee).

Enrolled Agent vs. CPA: What Are the Exam and Licensure Requirements?

EAs must complete 72 hours of continuing education every three years, with at least 16 hours each year. In contrast, CPAs must complete a certain amount of continuing education each year, depending on their state. Understanding these differences is crucial for your small business because choosing the wrong tax professional can have serious consequences. This article will explain the differences between an enrolled agent (EA) and a CPA, helping you make the right choice for your business.

- A CPA has a much wider scope of professional financial services compared to an EA.

- Where they vary is in the time nad effort needed to cross their respective finish lines.

- A remote bookkeeper is cost-effective, flexible, and experienced to help your organization manage your fiscal resources.

- Department of the Treasury to represent taxpayers before all administrative levels of the Internal Revenue Service for audits, collections, and appeals.

- The first step to hassle-free accounting, tax returns, and tax planning starts by reaching out to one of our representatives.

- Certified Public Accountants, or CPAs, are licensed accountants with the statutory privilege to sign an audit report.

However, if you currently meet the EA requirements, it may benefit you to continue on this path before working on your CPA license. Stephanie Ng began her career as an investment banker at Lehman Brothers in New York and Morgan Stanley in Hong Kong. She later joined her client to work in the Group Finance Department, where she spent five years specializing in corporate finance, mergers and acquisitions, and debt refinancing. She also extended her role to management accounting and financial accounting and obtained her U.S. While there could be exceptions to the rule, CPA licensure generally has a much higher barrier of entry than the enrolled agent credential.